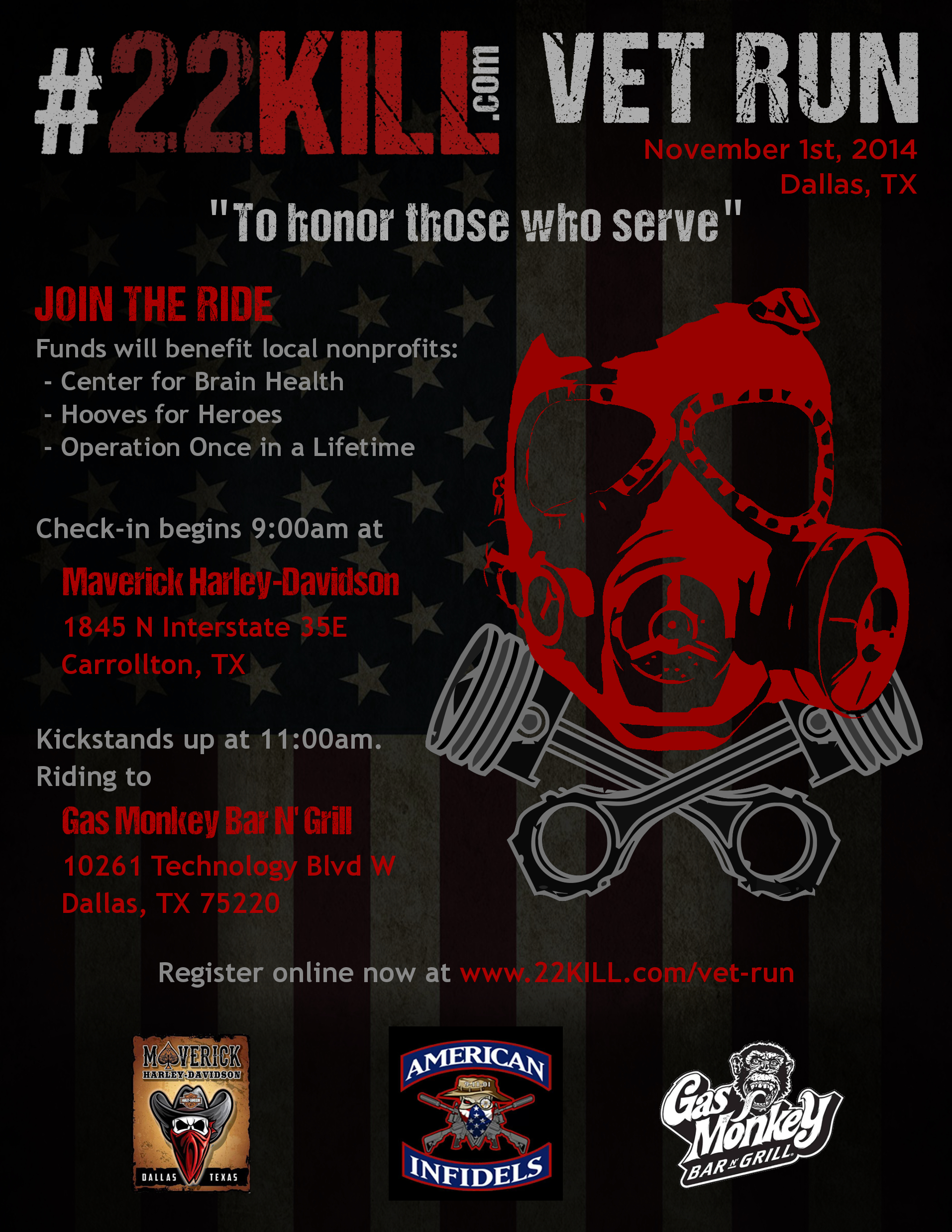

#22KILL Vet Run Fundraiser

Saturday, November 1st, 2014

#22KILL Vet Run is a one-day motorcycle fundraising event that’s open to everyone who supports veterans. You don’t have to ride a motorcycle to come support.

Join them as they honor our nation’s military and veterans. Proceeds will benefit Veterans through 3 vetted local nonprofit organizations: Operation Once in a Lifetime, Hooves for Heroes and Center for Brain Health’s Warrior Programs.

Check-in begins at 9:00am on the day of the event at Maverick Harley-Davidson, or you can register online now.

Single rider registration is $22, or $25 with a passenger / sidecar. If you want to ride along in a vehicle, you can register for $10. Any donations simply to support are welcomed and appreciated.

There will be live music, food & drinks, and a 50/50 raffle. Don’t forget to purchase a ticket for a chance to win a #22KILL Ducati.

Route (TBD) begins at

Maverick Harley-Davidson

1845 N Interstate 35E

Carrollton, TX

And ends at

Gas Monkey Bar N Grill

10261 Technology Blvd W

Dallas, TX 75220

For questions or concerns, please contact Jimmy Mackin at

jim@veteran.me

972-835-0876